CEO Nguyen Vu Linh had an interview with our partner Unifimoney about offshore software development in Fintech and the opportunities for Vietnam companies in this market.

Can you give us some background on yourself and Innotech Corporation Vietnam?

I am Linh Nguyen, CEO and Founder of Innotech Vietnam JointStock Company. A little background about Innotech, the company was established in 2014. As time passed by, the company has expanded to 5 branches: 2 in Japan, 2 in Vietnam — Ho Chi Minh City and Hanoi — and 1 branch in Texas, USA.

Innotech Vietnam’s office in Ho Chi Minh City

During the first few years, our clients’ portfolios varied from Education, Retail, Airline, Logistics to FMCG, and so on… The biggest turning point in the development of Innotech Vietnam was developing MobileBanking Platform for AsiaCommercial Joint Stock Bank (ACB), one of the biggest private banks in Vietnam, along with Commonwealth Bank partnership in 2017, and NAB.

Because of the crucial potential in Fintech market in Vietnam and other countries, we have boosted the engineering resources for this industry by hiring the best engineers. Our engineering teams are not only experts in development but also excel in English. We have built and developed projects strictly follow to CMMI standards and implemented projects according to Agile Process Model (MVP). This helps our customers shorten their development time and accelerate product launching date. We understand that honesty is the right courtesy. Based on the value we provided, we have rapidly amassed many customers in the Fintech sector in a short span of time.

How has the tech offshoring and outsourcing market in Vietnam evolved over the last few years? How does it compare to other major markets like India? Has Covid impacted this?

Great question. To begin, I will share an overview about our market. Vietnam is home to roughly 1 million young, skillful engineers. Realizing the shift in technology, Viet parents tend to invest in IT education and English skills for their children at an early age. With those advantages, Vietnam has been an outstanding offshore software development destination for the past 5 years.

We also focus on technological delivery aspects. This includes time commitment, delivery of high-quality software, and product improvement from the end-user’s perspective. Similar to any big tech company in the world (Twitter, Facebook), we set those attributes as defaults. With the right opportunities, I believe that Vietnam can outgrow the Indian market in the near future.

During the pandemic, a number of industries were restructuring the supply chain, so there were some fluctuations related to tourism and the airline industry. However, in Vietnam we recovered quickly, because the epidemic has been very well controlled. ITV is expected to grow ~200% in 2021, especially in the Fintech sector because of securities banking and online lending finance services.

You have a lot of Fintech experience in markets as diverse as Australia, South Africa and USA — what are the challenges you see in tech development work in Fintech and the similarities and limitations differences between countries?

In the Australian, South African, and American markets, there are some similarities — markets are geared towards convenience and one-stop service. The differences are user behavior, financial investment preferences, and government regulations. All of these differences affect app design. To fully understand the needs of different markets, it is always a challenge for programmers. We strengthen our team by training talent, working on communications, and continuously adding fluent and experienced English employees. Time zone difference is also an obstacle to us. However, we manage to overcome those easily by organizing a mutual timeline. Australia’s working time zone is better suited to Vietnam than the rest of the markets.

A lot of companies in the Bay Area have traditionally been against offshore software development and keeping it in-house, despite the costs and competitive nature of securing talent in such markets. What’s your view on this debate?

The first two factors that must be mentioned are company practices and the principles of economic growth, including productivity and cost. This applies to any country, not just the Bay Area. Opposition can be derived from many other reasons, but the main factors that decide whether a business succeeds or fails are the overall cost effectiveness and the efficiency of engineers. We have always prioritized innovating internally to meet the customers’ challenges. That brought a huge success to our company and over time, eventually, this will lead to a long-term business relationship.

The US personal finance market is at the same time one of the largest and most sophisticated markets for financial services and one of the most antiquated when it comes to infrastructure and processes at many legacy companies. How has it been to be a driver of innovative services in the US market? What’s it been like to support a company like Unifimoney, which is simultaneously working with both traditional and cutting-edge tech and business partner?

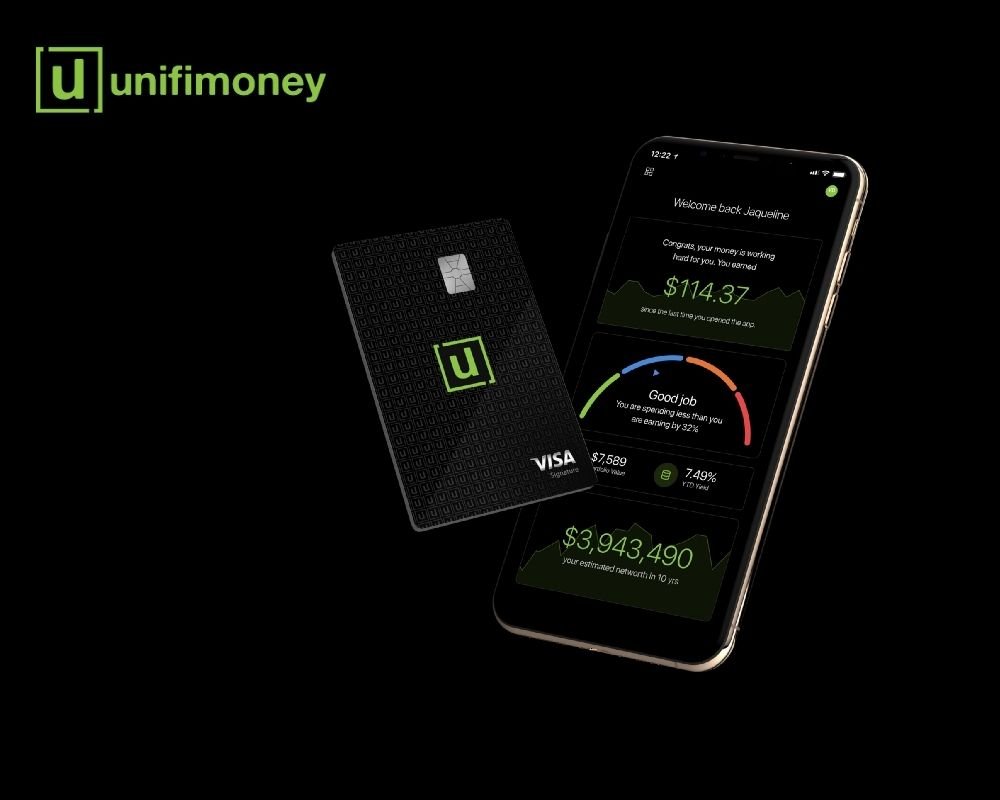

We go-lived MVP successfully in April 2020

Ben and Ed are visionaries, with a desire to change the market — I have known that from the first time I met them. I strongly believe that Ben and Ed will reach to the top of Fintech by building an application that outperforms the rest. In addition, I’m also surprised that in Vietnam many banks already have digital mobile banking applications, but in the US, there are still many banks that have not really invested in Fintech. This is a great opportunity for Unifimoney to dominate the market and play a pioneering role in the US Fintech industry in the near future.

Source: Unifimoney