AI chatbots for banking is becoming increasingly widespread. The features of this tool are being enhanced and diversified, helping banks strengthen their competitive advantage. By fully understanding the functions of this tool, banks can achieve multiple benefits and their business goals. In the following article, Innotech will show you 5 ways to use AI chatbots for banking to improve enterprise performance.

1. Why should you use AI chatbots for banking?

Using AI chatbots for banking has become an inevitable trend in the new context of the financial – banking industry. Especially as E-banking and smart banking models have become popular payment methods worldwide. The impact of both internal and external factors is driving the adoption of AI chatbots for banking. Some reasons behind this rapid growth include:

-

The strong development of technology,

-

Rapidly changing digital customer behavior,

-

Intense competition among banks in the race for market share,

-

The demand for a technology that can integrate with new trends such as fraud detection, e-wallets, and blockchain,…

-

The requirement to optimize operational costs and improve internal efficiency.

Reasons why we should use AI chatbot for banking

2. 5 ways to apply AI chatbots for banking

With the reasons above, using AI chatbots for banking will bring many benefits such as: enhancing competitiveness, improving customer experience, keeping up with technology trends, and increasing technological network connectivity… in your business.

There are 5 ways to use AI chatbots for banking as follows:

2.1. Using AI chatbots for banking to support customers 24/7

AI chatbots for banking have become an essential digital service channel that ensures customers receive instant and personalized assistance at any time. Unlike traditional call centers, AI chatbots simulate natural human conversations using natural language processing (NLP) and machine learning to understand intent and deliver relevant responses. By analyzing historical interactions and real-time data, these systems can provide accurate, context-aware solutions to diverse customer needs — from account inquiries to transaction support.

Using AI chatbots for banking to support customers 247

More importantly, using AI chatbots for banking is not affected by service interruptions caused by high user volume at the same time. Even with thousands of customers accessing simultaneously, the AI chatbot still ensures instant and efficient handling. Therefore, integrating AI chatbot for banking into a website or banking app is considered a smart replacement for traditional consultants. Operating 24/7, AI chatbots for banking significantly enhance service accessibility, reduce human workload, and strengthen overall customer satisfaction in the digital banking ecosystem.

2.2. Using AI chatbots for banking to handle basic financial transactions

AI chatbots for banking are evolving beyond customer service to perform fundamental financial transactions securely and efficiently. Through voice recognition and natural language processing (NLP), customers can issue voice commands to transfer money, pay bills, or recharge accounts within seconds. These chatbots can also provide real-time balance checks, assist in card applications, update personal details, and offer step-by-step service guidance without requiring customers to visit a branch. By automating routine operations, AI chatbots for banking not only enhance convenience and accessibility but also free human staff to focus on complex, value-added financial services.

Using AI chatbots for banking to handle basic financial transactions

2.3. Using AI chatbots for banking for personal financial advice

AI chatbots for banking act as intelligent financial assistants that analyze each customer’s spending habits and preferences. By monitoring daily transactions, they can detect abnormal spending patterns and offer timely alerts or advice. For example, if a customer spends significantly on dining, the chatbot may suggest a credit card with restaurant cashback rewards. Beyond expense tracking, AI chatbots can recommend personalized saving plans and investment options suited to each customer’s income level and goals.

For customers with stable incomes, AI chatbots can suggest fixed-term deposits or allocate part of their funds into low-risk investment portfolios. When customer goals change (buying a house, children’s education, long-term travel…), the AI chatbot can adjust financial recommendations and roadmaps accordingly.

Using AI chatbots for banking for personal financial advice

Over time, these chatbots continuously learn from customer behavior, refining their suggestions to improve financial management efficiency and decision-making. This not only enhances user experience but also strengthens customer loyalty by providing proactive, data-driven financial guidance.

2.4. Using AI chatbots for banking to detect and warn about fraud

AI chatbots for banking play a vital role in fraud detection by integrating with real-time data analysis and behavioral monitoring systems. They continuously analyze customer transactions to identify suspicious activities such as sudden large transfers, transactions in unusual locations, or multiple failed login attempts. Once abnormal behavior is detected, the chatbot immediately alerts customers through notifications, SMS, or in-app messages.

Using AI chatbots for banking to detect and warn fraud

Additionally, the system can temporarily freeze transactions until the customer confirms their legitimacy. Over time, AI chatbots learn from confirmed fraud cases to enhance detection accuracy and reduce false alarms. By providing instant warnings and proactive protection, AI chatbots not only safeguard customer assets but also help banks maintain trust, security, and operational integrity in the digital era.

>> Learn more: 5 trends shaping the future of fraud detection using AI in banking

2.5. Using AI chatbots for banking to collect customer insights and cross-sell

Using AI chatbots for banking to analyze customer insights

AI chatbots for banking are not only customer service tools but also powerful data collection systems. By engaging with customers daily, they record detailed information about preferences, transaction habits, and life events such as travel, family, or career milestones. These insights allow banks to segment customers and predict their financial needs more accurately. Based on this analysis, AI chatbots can suggest relevant products—such as insurance for frequent travelers, savings plans for young families, or investment options for professionals. This personalized cross-selling strategy enhances customer satisfaction while driving higher revenue and loyalty for the bank. Over time, the chatbot’s learning algorithms refine these recommendations, making them increasingly precise and context-aware.

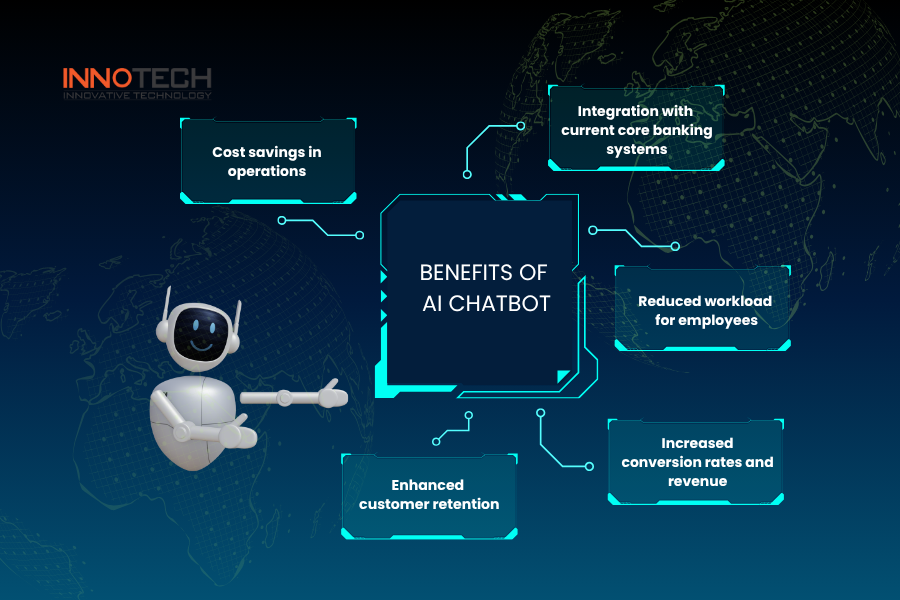

Benefits of using AI chatbots for banking

It is not difficult to understand how to use AI chatbots. Many banks have outsourced AI software development services to integrate AI chatbots and have achieved the following benefits:

-

Cost savings in operations: AI chatbots replaces many tasks of call center staff or tellers, reducing HR and infrastructure costs, especially in repetitive tasks.

-

Integration with current core banking systems: AI chatbots directly integrates with core banking, CRM, and digital transaction platforms, ensuring smooth operation without requiring a complete IT infrastructure overhaul.

Benefits of using AI chatbots

-

Reduced workload for employees: Routine tasks such as checking balances, resetting passwords, or service guidance are handled automatically by the chatbot, freeing staff to focus on more complex tasks like credit consulting, risk management, or VIP customer care.

-

Increased conversion rates and revenue: Thanks to its ability to recommend relevant products (cross-selling, upselling), AI chatbots maximizes customer value and boosts service registrations.

-

Enhanced customer retention: Fast convenient experiences encourage long-term customer loyalty. As a result, AI chatbots reduces customer acquisition costs and optimizes customer lifetime value.

3. Case study

Unifimoney from the U.S. is a typical example. Its business operations are now strongly supported by an intelligent AI chatbot. Specialized AI integrated into the chatbot has:

-

Replaced human consultants

-

Provided analysis

-

Suggested investments

-

Delivered real-time market analysis

-

Optimized user experience

-

Reduced operating costs, especially in consulting

-

Improved customer service

Customers of Unifimoney is using Ai chatbot to answer financial inquiries

As a result, staff costs and operating expenses have been significantly reduced. At the same time, customer experience has been enhanced through the use of this software.

We’ve just explored 5 of the most popular ways AI chatbots are shaping the future of banking. To receive consulting on how to integrate AI chatbot services in the Finance – Banking sector, please leave your details TẠI ĐÂY.