A P2P Lending Application can help both lenders and borrowers have a good experience when using services. Aside from that, investing in P2P Lending Application Development gives a great advantage in cost reduction. So, many companies are looking for a mobile application development company.

Finding a reliable P2P Lending Application Development Company is very difficult because the software market has a larger amount of providers and you have no idea about hiring them. Let’s keep reading this article it can give you a helpful suggestion.

Benefits of P2P Lending App for borrowers

No interference of intermediary

In a P2P lending app, there are no banks or an intermediary involves. So the users neither need to pay for the banking services nor have to convince the creditor to issue a loan that users are solvent & trustworthy. All the processes are carried on a single mobile application at the expense of minimal fees.

Flexible than traditional loans

Mostly, P2P loans are unsecured because the borrower doesn’t need to provide any collateral. So users won’t need to tie personal assets or property like the case with the traditional loans. In P2P lending app, the application process is quick and uncomplicated. Thus, users can easily access funds in a short duration.

Lower Interest Rates

The loans that users will get on peer-to-peer lending would charge quite less interest rate in comparison to the traditional lenders like banking and financial institutions. As the investors are lending their money directly to the borrowers through an application platform, there are no intermediaries, by which both parties can leverage from more favorable rates.

Thorough Inspection

While there is no need for collateral, still the borrower had to submit personal information such as passport, identity card, salary and others to prove their solvency. A P2P loan app always provides users with a high level of trust.

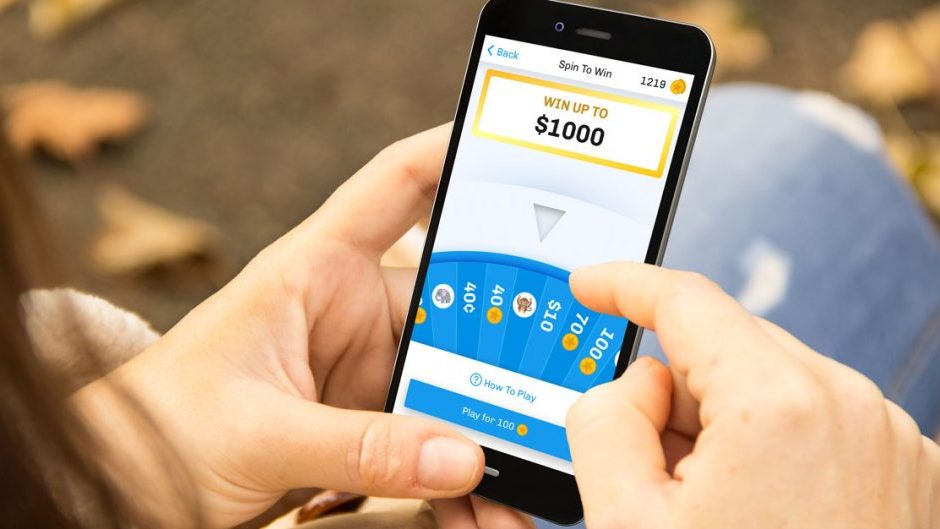

Benefits of P2P Lending App for lenders

Steady & Attractive Returns

The current average rate of return on a P2P loan lending app is 10%. However, it depends on the type of loan and the duration. In the current banking market, a 10% return is quite attractive, especially if it is diversified from qualified borrowers.

Lenders Choose

As a money lender, users can categorize the borrowers and can check their identification. They will get all the details of a borrower along with its credit score, and other related factors in the funding algorithm. So, users can choose to invest in borrowers who match their preferences.

Fraud Prevention

The risk for money lenders is not getting their money back. However, a P2P Lending App Development implements a Fraud Prevention System in order to maintain a zero-tolerance policy on fraud. The best P2P lending app always follows procedures that are the strictest and most rigorous within this industry.

Innotech Vietnam

Innotech Vietnam is a reliable mobile app development company in Vietnam. Be appreciated for high-quality products, services, and innovative solutions in a fintech company. We strive to create innovation and develop advanced fintech solutions. We provide a wide range of mobile application services, ready to meet all customer service requirements. The products and solutions we offer based on these advanced technologies become valuable for our customers through professional project management methods and tools to help customers effectively manage progress and resources a force of the project.

Innotech’s head office

Innotech’s head office

Innotech Vietnam has done more than 200+ mobile app projects for clients worldwide in Japan, the USA, Australia, Singapore and Vietnam. We’re confident to deliver even the most complicated mobile app development project successfully in areas such as banking and financial, logistics, transportation, education, and other industries. More than 90% of companies have kept coming back to Innotech for a wide range of Phát Triển Ứng Dụng Di Động and they enjoy the same standard of service every time. Besides, we are proud that we are trusted by many Institutions in Banking and Finance such as Ngân hàng ACB, Tyme Bank, Unifimoney, Manulife, Ngân hàng Commonwealth, …

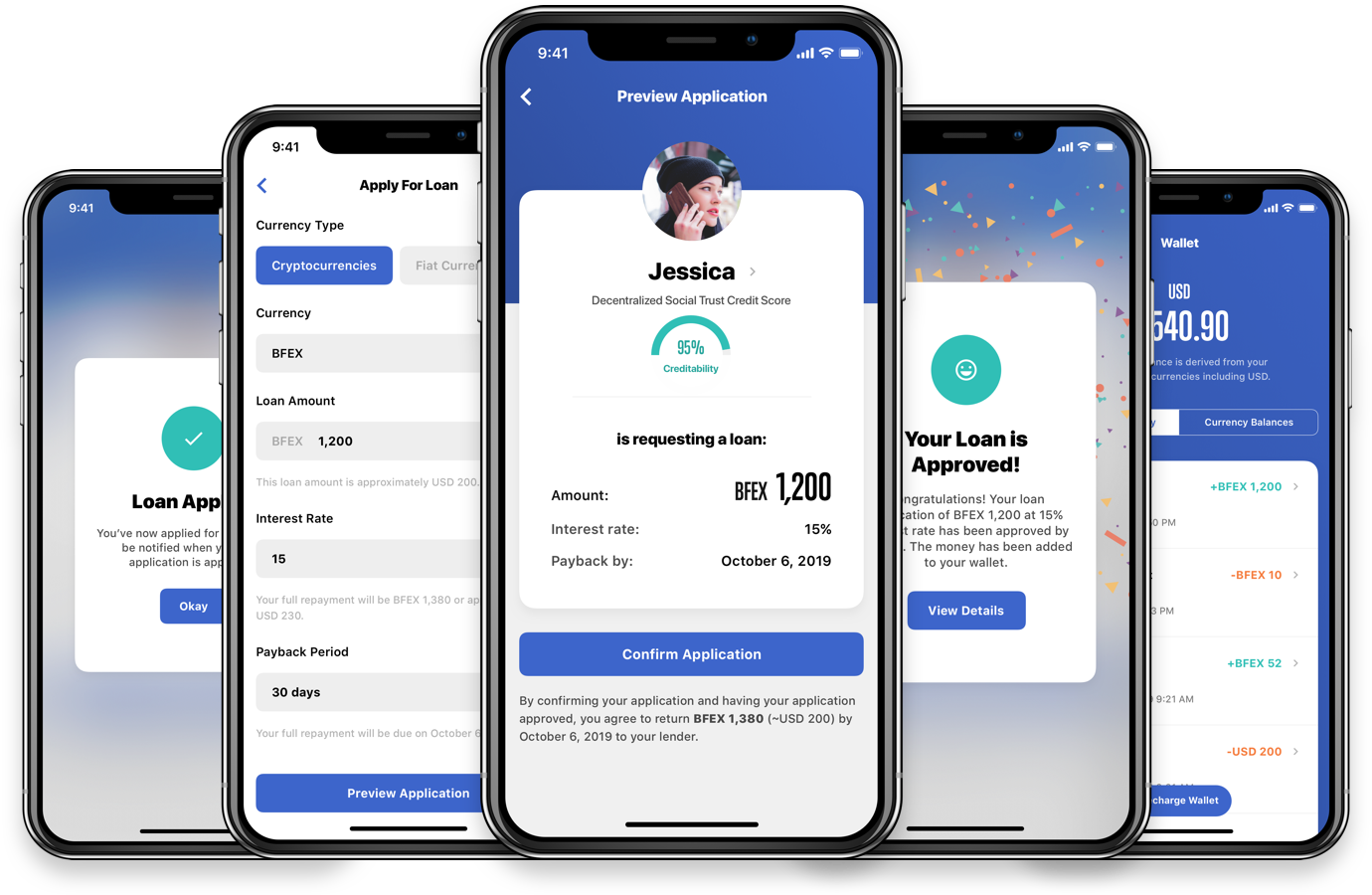

P2P Lending Application Development Services

- Lender Management. Lender Management helps lenders in investing money by selecting borrowers of their choice within the application. A lender can check the details such as the amount required, loan tenure, and profile for KYC.

- Borrower Management. It helps the borrowers for submission of details like KYC, E-sign, and other personal information. The borrower needs to upload documents, credit history, and business accounts for getting loans.

- Push Notifications. If users agree to allow push notifications, they will receive timely alerts or notifications about their order, any new offer, policy, etc.

- Real-time analytics. Real-time analytics helps users to get insights and act on data immediately or soon after the data enters their system. Moreover, real-time app analytics can answer queries within seconds.

- KYC Approval. KYC approval helps both lenders and buyers for their verification on the platform. The admin would approve the KYC if all documents are correct.

- CRM integration. Customer Relationship Management (CRM) tool integration can help apps to build better customer relationships and increase retention rates, user engagement, conversion rates.

- Loan Management. Loan management will keep all the records of the loan, amount, transactions, histories, lender, and borrower details, and other data.

- Payment Schedule. The repayment scheduler will help the borrowers and lenders to get notifications about the upcoming installments.

- Chatbot support. Chatbot support will help users to resolve any queries arise for the features & functionalities.

Why should you choose Innotech Vietnam?

-

Expert by experience

With more than 12 years of experience, Innotech Vietnam has experience in core banking software integrations for financial institutions such as Ngân hàng ACB, Tyme Bank, Unifimoney, Manulife, Ngân hàng Commonwealth, etc.

-

Ready solutions

Technical solutions and demonstration of a product or technique are available.

-

Dedicated teams

With more than 90+ mobile app developers, UI – UX Design, BA, project managers and QA/QC. Innotech staffs have good knowledge of banking and financial operation.

Young, dynamic, professional and creative engineers combined with highly experienced experts

Young, dynamic, professional and creative engineers combined with highly experienced experts

-

Reputation

Experience in consulting, deploying and managing mobile applications with more than 2 million users.

-

Cybersecurity

Maintaining the security and confidentiality of our clients’ projects is always our top priority. We try our best to respond to cybersecurity standards for the partner.

Read more case study:

- ACB BANK – MOBILE APP DEVELOPMENT CASE STUDY

- MANULIFE – INSURTECH SOLUTIONS CASE STUDY

- TYMEBANK – SHORTAGE OF HIGH-QUALITY ENGINEERS AND SOLUTIONS.

- UNIFI.MONEY – NEO BANK APPLICATION DEVELOPMENT

If you are looking for a Mobile App development company to provide solutions for digital wallet companies, we’re happy to grant our services. Contact experts at Innotech Vietnam for any questions about Mobile Application!