In the Finance – Banking industry, customers always want to experience simple services with good quality. They are too frustrated when it comes to complicated, confusing and time-consuming procedures to go through the bank. Therefore, the trend of digital transformation in banks becomes inevitable, pushing banks to race strongly, especially in the context of the Covid-19 pandemic raging and forecast to last.

Customer Demand

The driving agent for digital transformation in banking

The demand for online transactions is increasing rapidly. Advantages come from customers accepting appropriate fees, learning and learning new technologies to satisfy the convenience and speed of technology in the 4.0 era.

Over the past year, banks have been racing to convert digitally and launch and upgrade applications to super apps. Almost all banks on the market allow customers to make payments, transfer and link e-wallets, open online cards, save deposits, loans … online without having to go to the headquarters sign papers.

Banks also recognize the importance of digital transformation in banks with many advantages. Help save time and increase productivity by automating some processes, and data gradually digitized also makes storage, modification, search and retrieval easier.

Vietnam has many favorable conditions for the development of digital banking thanks to its large population of 96 million people, a golden population structure (56 million people participating in the labor market); the smartphone ownership ratio is quite high (72%), with 62 million subscribers with 3G/4G internet connection, and a young population who are fancy of technologies.

According to a study by the State Bank (SBV), at present, 94% of banks have initially implemented or are researching, building digital transformation strategies; of which, 59% of banks have started to implementing digital transformation in practice. Only 6% of banks have yet to consider building an overall digital transformation strategy. Digital transformation will enhance the competitiveness of banks, expand to remote areas and retain customers outside of territories.

Benefits of digital transformation in bank

Benefits of digital transformation in bank

Benefits of digital transformation in bank

Laws and legal institutions in Vietnam are facilitating digital transformation in bank and securing cybersecurity. The State of Vietnam has assisted in completing the legal framework and mechanism in the banking sector, creating favorable conditions to promote business models and business administration in the banking sector in a breakthrough direction, innovate, while still focusing on ensuring network security, protecting the interests of consumers, and minimizing risks.

Security and confidentiality are valued because the data nature of banks is unique, eKYC can satisfy that. The eKYC technology solution satisfies the identification procedures, verifies accuracy and transparency to avoid data theft and fraud. The advent of eKYC solutions laid the first bricks to build digital banking facilities, and to automate the operations of financial businesses and banks.

Processes in eKYC are often built and operated by third parties – companies that specialize in providing quality technology solutions according to their own requirements. Easily expand new services and upgrade systems. Save costs in infrastructure investment when the software uses virtual servers but still ensure smooth operation and convenience in access anytime, anywhere.

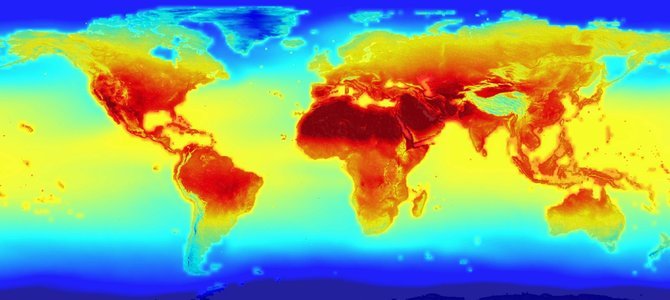

Natural risk

Climate change transforms demand

Climate change transforms demand

Fear of unpredictable diseases and natural disasters with climate change is also a push for online services to thrive. It will be safer to make transactions such as online shopping, periodical savings, online insurance … to avoid the risk of Covid-19 or an unlucky weather accident.

Conversion of the traditional model to digital banking is indispensable in the bank’s operations to satisfy and best serve customers. But banks will need to plan a clear path and choose the right solution provider for long-term growth. There will be many challenges ahead and along with the opportunities of digital transformation in bank in Viet Nam.

Synthesize and translate Innotech Vietnam

Innotech Viet Nam Corporation is a software outsourcing company focusing on high-quality services in Viet Nam. At Innotech Vietnam, We strive for the creation, innovation, development, and advanced solutions. We provide a wide range of software services to meet all requirements and expectations from customers. We turn these advanced technologies into value for our customers through our professional solutions and business service worldwide.

Contact experts at Innotech Vietnam for any questions about Software outsourcing development questions!

Email: [email protected]