The global scale and sophistication of banking fraud are increasing at an alarming pace. This poses an urgent requirement for banks to strengthen their capabilities in fraud detection and prevention. As a result, implementing a fraud detection system using AI in banking has become a smart and forward-looking choice. In this article, we will explore five key trends shaping the future of AI-driven fraud detection in the banking industry.

1. The current state of banking fraud

In today’s 4.0 era, we are witnessing a continuous rise in high-tech fraud and increasingly sophisticated schemes in the financial and banking sector.

According to Business Standard (India): Banks in the country recorded as many as 36,075 fraud cases in the 2024 fiscal year. Losses amounts to 26,127 crore rupees. Notably, more than 89% of the reported fraud value actually originated in previous years, highlighting a significant delay in detection.

Banking fraud occurs across many countries and regions.

According to the Global Financial Fraud Assessment (INTERPOL, May 2024), in the Americas, police carried out the arrest of more than 100 individuals and froze 200 accounts involved in fraud in 2023. Europe was recorded as the region with the highest rate of financial fraud, with more than 80% of cases involving technology.

This situation shows that not only a single country or region, but the entire world is facing economic losses and challenges to customer trust caused by the negative impacts of banking fraud.

2. Why has AI-based fraud detection in banking become a trend?

With the pressing situation mentioned above, traditional fraud control methods are gradually proving to be outdated and slow. Artificial intelligence has already become a powerful weapon for fraudsters. Therefore, applying AI in banking fraud detection is no longer just an option but has become an inevitable trend. At present, many technology companies are providing AI software development services for the banking industry. This clearly demonstrates that the adoption of AI in the BFSI sector is a continuously growing trend.

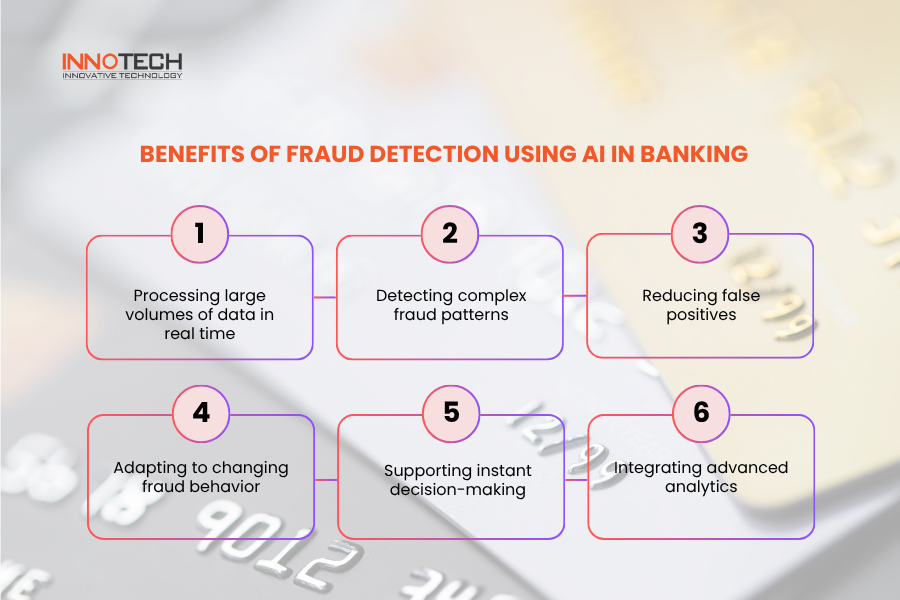

Fraud detection using AI in banking brings many benefits, such as:

-

Processing large volumes of data in real time: AI can instantly analyze millions of transactions, faster and more comprehensively than humans.

-

Detecting complex fraud patterns: Machine learning, deep learning, and graph analytics identify new fraudulent behaviors that fixed rules struggle to uncover.

-

Reducing false positives: By examining multiple attributes simultaneously and learning from historical data, AI reduces the number of false alerts that require manual review.

-

Adapting to changing fraud behavior: AI models continuously update from new data, helping banks stay ahead of evolving fraud tactics.

-

Supporting instant decision-making: AI assigns risk scores to each transaction, allowing the system to automatically block or prioritize investigations.

-

Integrating advanced analytics: Techniques like anomaly detection, behavioral biometrics, and graph analysis enable the discovery of hidden links and unusual activities more effectively.

6 benefits of fraud detection by using AI in banking

3. Five trends shaping the future of fraud detection using AI in banking

AI-powered fraud detection in banking is gradually establishing itself as an effective tool for risk management. The technological advancements in this field are evolving along five key trends.

3.1. Real-time fraud detection using AI in banking

Fraud detection using AI in banking has become a crucial trend for enhancing transaction security and risk management. AI systems employ machine learning, anomaly detection, and predictive analytics to monitor transaction data in real time and identify suspicious behaviors within seconds.

Unlike traditional models, AI can continuously learn and adapt to new fraud methods such as synthetic identities or cyberattacks. As a result, fraud detection using AI in banking not only minimizes financial losses but also strengthens customer trust and ensures regulatory compliance in an increasingly digital environment.

3.2. Fraud detection using AI in banking through machine learning and deep learning

Fraud detection using AI in banking through machine learning (ML) and deep learning (DL) allows financial institutions to detect sophisticated fraud patterns that evolve beyond traditional rule-based systems.

ML models learn from vast transaction histories to identify anomalies and predict potential risks, while DL architectures such as neural networks and autoencoders analyze high-dimensional data to uncover hidden irregularities. These AI models continuously retrain as new behaviors emerge, enabling dynamic adaptation to modern fraud tactics. By integrating supervised and unsupervised learning, banks can detect both known and unknown fraud types, improving accuracy, speed, and overall resilience of digital financial systems.

Fraud detection in banking using machine learning and deep learning

3.3. Fraud detection using AI in banking through customer behavior analysis and big data

Fraud detection using AI in banking increasingly relies on customer behavior analysis and big data to enhance accuracy and responsiveness. In regions like the Americas and Europe, AI systems process massive datasets from transaction histories, device usage, geolocation, and spending patterns to build dynamic customer profiles. Any deviation from normal behavior is instantly flagged as potential fraud. This integration of behavioral analytics with large-scale data processing enables real-time and personalized fraud prevention. As this technology trend evolves, banks in Asia are expected to accelerate adoption, aiming to strengthen digital trust and protect customers against emerging financial crimes.

3.4. AI fraud detection in banking using graph analytics and deep learning for organized fraud detection

Fraud detection using AI in banking with graph analytics and deep learning allows institutions to uncover hidden relationships between accounts, devices, IP addresses, and behavioral patterns. By mapping these connections, AI systems detect fraud clusters and coordinated activities that traditional models often overlook.

Deep learning enhances this process by recognizing complex correlations within large, dynamic datasets. Through graph-based visualizations, banks can trace how organized fraud networks operate and identify vulnerabilities in their risk management systems. This integrated approach strengthens predictive capabilities, enabling early intervention and more effective prevention of large-scale financial crimes.

Fraud detection in banking using AI through graph analytics

3.5. Fraud detection using AI in banking through multi-technology integration and cross-border cooperation

The advancement of fraud detection using AI in banking increasingly involves multi-technology integration and cross-border cooperation. Emerging technologies such as biometric authentication, cloud computing, and blockchain are being embedded into AI-based systems to enhance data accuracy, transparency, and traceability. These integrations allow financial institutions to authenticate users securely, detect anomalies faster, and trace fraudulent transactions across networks.

At the same time, international banks are building real-time data-sharing ecosystems to combat cross-border financial crimes. This collaborative technology trend establishes a global anti-fraud network that strengthens resilience, regulatory compliance, and collective defense against increasingly sophisticated cyber threats.

The above are the five major trends shaping the future of fraud detection using AI in banking. Innotech hopes you find this information useful and applicable to your bank’s risk management practices.