The digital transformation revolution has profoundly reshaped the banking industry. Not only have products evolved, but service delivery processes and customer interactions have also undergone rapid changes. The key challenge now lies in how to enhance the customer experience transformation in banking while maintaining operational efficiency and cost-effectiveness.

In this article, you will find five effective solutions to improve the customer experience transformation in banking, along with essential considerations for implementing these approaches successfully.

1. Methods for enhancing customer experience transformation banking

1.1. Enhancing customer experience transformation banking through digital technology

Customer experience transformation banking can be achieved through the strategic application of digital technologies. An omni-channel platform, integrated with Single Customer View (SCV), Single Sign-On (SSO), and event streaming, synchronizes customer sessions and profiles across websites, mobile applications, call centers, and traditional branches, thereby reducing friction between touchpoints. When combined with AI-driven behavioral analytics and personalization engines, banks can recommend suitable products, shorten the decision-making journey, and increase transaction completion rates. This approach not only enhances convenience but also strengthens customer engagement and satisfaction, laying the foundation for a seamless digital banking experience.

Enhancing customer experience transformation banking through digital technology

Customer experience transformation banking requires not only technological innovation but also synchronized organizational management. An integrated system helps reduce the workload at physical branches, reallocates human resources toward high-value services, and enhances security through biometric authentication and data encryption. Banks must also establish strong data governance frameworks and set clear KPIs to measure digital adoption, abandonment rates, and Net Promoter Score (NPS). By implementing pilot projects and continuously optimizing processes, this approach ensures a sustainable return on investment (ROI), minimizes risks, and strengthens scalability across the organization.

>>> Learn more: Top 5 companies providing fintech app development in 2025

1.2. Enhancing customer experience transformation banking through automation and smart services

The adoption of automation technologies enables banks to improve service speed while reducing operational costs. At the same time, customer experience transformation banking becomes smoother and more seamless, without disrupting the customer journey.

One of the most effective solutions is the implementation of multilingual AI chatbots that operate 24/7 to instantly address inquiries and provide real-time customer support. This proves especially valuable in the context of global banking, where customers differ in both language and time zone, ensuring accessibility and responsiveness at any time, from anywhere.

Enhancing customer experience transformation banking through automation and smart services

In addition, virtual financial advisors and user-friendly mobile applications help personalize banking services based on customers’ digital habits and behavioral patterns in each market. Customers can easily manage their finances, investments, or payments, while banks strengthen their ability to connect, build trust, and enhance long-term customer loyalty.

1.3. Enhancing customer experience transformation banking through improved security and digital trust

In the process of digital transformation within banks, security plays a crucial role in maintaining customer trust. The application of modern technologies such as biometric authentication (fingerprint, facial recognition) and AI-based fraud detection systems significantly strengthens transaction safety and enables early detection of online fraud.

Enhancing customer experience transformation banking through improved security and digital trust

Moreover, banks must ensure strict compliance with international security standards such as PCI DSS and ISO 27001, while also adhering to local legal and regulatory frameworks in each operating market. This dual compliance approach helps safeguard customer data, reinforce confidence, and build a secure foundation for sustainable customer experience transformation banking.

1.4. Enhancing customer experience transformation banking through workforce training and restructuring

Employees serve as the direct bridge between the organization and its customers. They not only need to be trained in digital skills and proficient in using new technological tools, but also equipped with a customer experience mindset. By proactively providing support and delivering value that exceeds customer expectations, banks can significantly improve customer experience transformation banking.

Enhancing customer experience transformation banking through workforce training and restructuring

Building a workforce that understands both technology and empathy ensures that every interaction — whether digital or in-person — contributes to a seamless, human-centered experience. This alignment between human capability and digital strategy is essential for achieving long-term success in customer experience transformation.

1.5. Enhancing customer experience transformation banking through open financial ecosystem integration

One of the key trends in digital banking transformation today is expanding collaboration within the open financial ecosystem. By connecting banks with fintech companies, e-wallets, and super apps, financial institutions can not only broaden their service offerings but also deliver a more seamless and unified experience to customers.

Enhancing customer experience transformation banking through open financial ecosystem integration

This approach enhances customer experience transformation banking by creating an interconnected network where customers can access multiple services — from payments to investments — within a single platform. At the same time, it strengthens the bank’s competitive position in an era where digital consumer behaviors are evolving rapidly, helping institutions stay relevant, adaptive, and customer-centric.

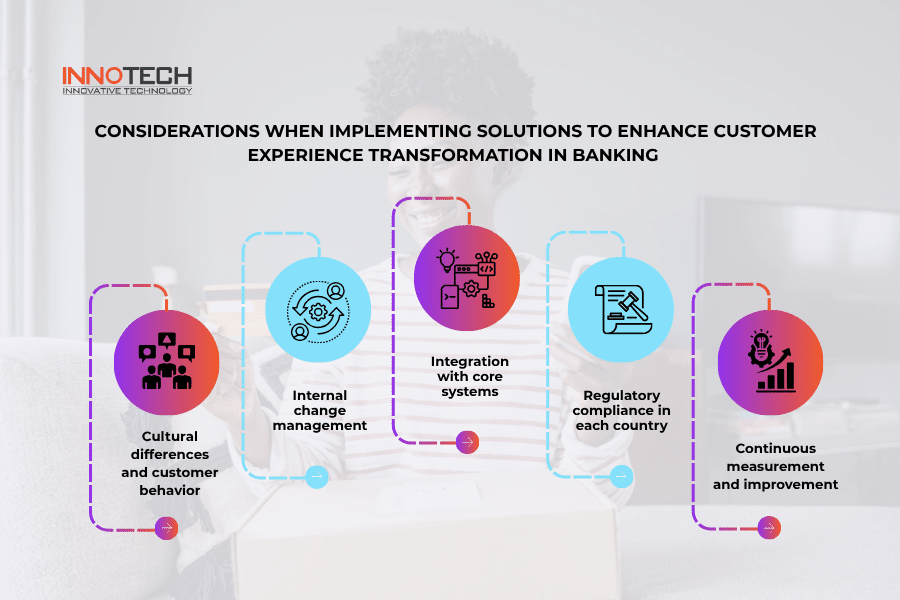

2. Key considerations when implementing customer experience transformation banking solutions

2.1. Cultural and behavioral differences among customers

When implementing initiatives to enhance customer experience transformation banking, financial institutions must pay close attention to cultural and behavioral differences across markets. Each country has unique characteristics in how customers adopt and interact with digital services, meaning that a one-size-fits-all approach may limit effectiveness. Understanding these nuances allows banks to design tailored strategies, optimize the customer journey, and foster deeper, long-term engagement with local clients.

2.2. Internal change management

Internal change management plays a critical role in ensuring the customer experience transformation banking process runs smoothly and sustainably. A well-defined roadmap should include stages such as communication, training, pilot testing, and full-scale implementation. This helps employees understand the goals and benefits of transformation, reducing resistance—especially from those accustomed to traditional workflows or concerned about technology replacing their roles.

2.3. Integration with core banking systems

One of the major challenges in customer experience transformation banking is integrating new solutions with legacy core systems. These systems are often complex, costly to maintain, and difficult to upgrade, yet remain central to transaction processing and data management. If new solutions are not compatible, they may cause service disruptions, data loss, or reduced operational performance—directly undermining the customer experience banks aim to enhance.

>>>Learn more: AI integration solutions for core banking systems

Key considerations when implementing customer experience transformation banking solutions

2.4. Compliance with legal regulations in each country

During the process of customer experience transformation in banking, compliance with legal regulations in each country is a mandatory requirement to ensure sustainability and avoid legal risks. Each market has its own regulatory framework regarding data management, privacy rights, transaction security, and partnerships between banks and fintech companies.

2.5. Continuous measurement and improvement

Measuring the effectiveness of customer experience transformation in banking initiatives is a prerequisite for maintaining competitive advantage and creating sustainable value. Key performance indicators (KPIs) such as CSS, NPS, and the rate of digital service usage directly reflect the success of the implemented strategies. At the same time, analyzing data on user behavior, transaction time, and digital engagement levels helps banks identify bottlenecks that need improvement. As a result, banks can maintain flexibility, enhance the customer experience, and meet the ever-increasing expectations of their clients.

3. Innotech – A trusted technology partner helping banks enhance customer experience transformation

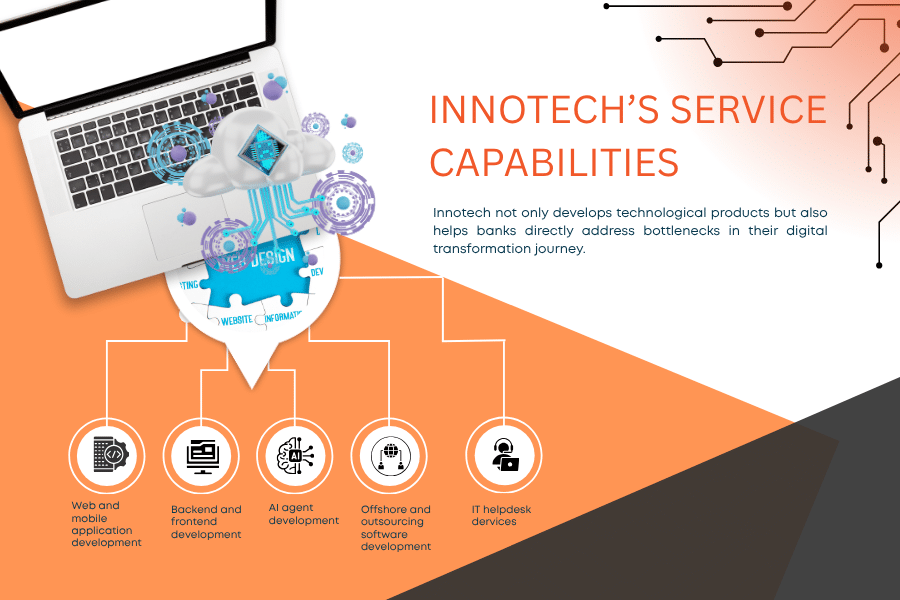

3.1. Innotech’s service capabilities

Innotech not only develops technological products but also helps banks directly address bottlenecks in their digital transformation journey. All services are designed with the goals of delivering seamless customer experiences, ensuring operational security, and enabling rapid deployment.

Key services include:

Innotech’s service capabilities

- Web and mobile application development: Providing customized solutions that help businesses save time, optimize processes, and improve operational efficiency throughout their digital transformation journey.

- Backend and frontend development: Building secure backend systems and intuitive UI/UX interfaces to minimize transaction errors and enhance user-friendliness in digital banking services.

- AI agent development: Offering AI chatbots, virtual assistants, and behavioral data analysis to personalize services and detect fraud in real time.

- Offshore and outsourcing software development: A team of experienced engineers helps banks deploy projects faster, reduce personnel costs, and shorten time-to-market.

- IT helpdesk dervices: 24/7 support to promptly resolve issues and ensure uninterrupted customer experience.

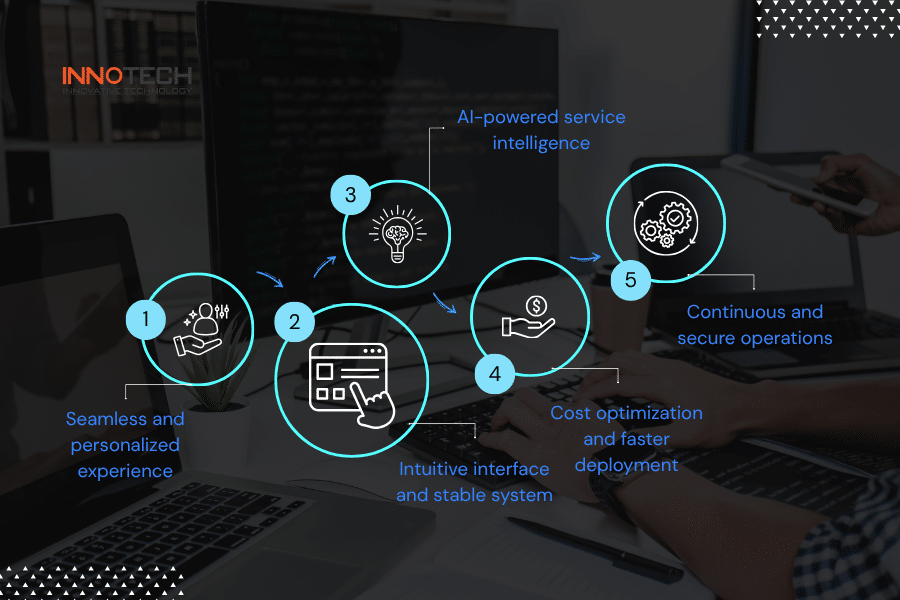

3.2. Benefits Innotech brings to banks in customer experience transformation

- Seamless and personalized experience: When banks launch new apps or upgrade systems, customers can continue transactions smoothly without “lags” or interruptions.

- Intuitive interface and stable system: Upgrading the core application with user-friendly and visually appealing UI/UX enhances the overall banking experience.

- AI-driven service intelligence: Multilingual chatbots available 24/7 can reduce call center workload by up to 40% while maintaining high customer satisfaction.

- Cost optimization and faster implementation: Supported by an experienced and dedicated team, Innotech offers service costs that are 20% lower than those in Europe and the Americas.

- Continuous and secure operations: The 24/7 IT helpdesk minimizes downtime, ensuring reliability and customer trust in digital banking services.

Benefits Innotech brings to banks in customer experience transformation

Leave your contact information here for consultation.

In an increasingly competitive environment and amid rising customer expectations, customer experience transformation in banking is no longer optional—it is vital for maintaining engagement and loyalty. Comprehensive technology solutions deliver seamless and personalized experiences. By partnering with Innotech, banks can accelerate their digital transformation, enhance customer value, and strengthen their competitive position in the digital financial market.