CASE STUDIES

Providing a wide range of technological services, Innotech Vietnam assisted many clients to leverage their business, as well as emphasizing the performance, productivity and flexibility of enterprise system.

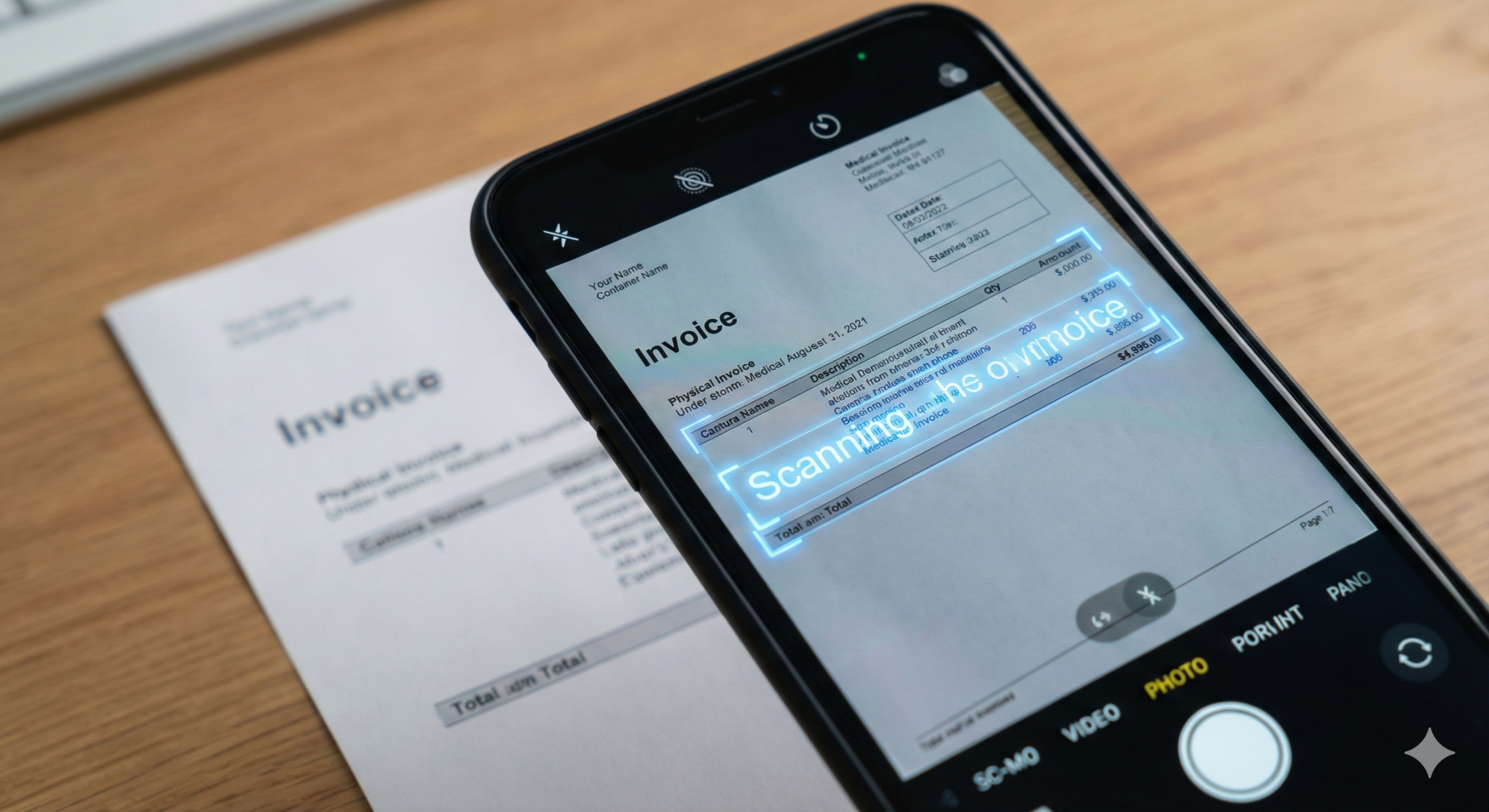

XCLAIM – Scan and Claim

Xclaim uses OCR AI technology to help you easily file insurance claims by scanning and recognizing relevant documents.

Industry: AI Tech

Region: Vietnam

Technology: Nextjs, Nodejs, MongoDB

Kinly Bank

Kinly is a fintech company that supports Black American communities.

Industry: Fintech

Region: US

Commonwealth Bank

Commonwealth Bank of Australia, commonly known as Commonwealth Bank, is one of Australia’s largest and most prominent banks, offering a wide range of financial services, including personal and business banking.

Industry: Fintech

Region: AUS

Technology: Swift, kotlin, Java, AWS, Docker, Redis, Kafka

UOB (United Overseas Bank)

United Overseas Bank (UOB) is one of the largest banks in Southeast Asia, headquartered in Singapore. Established in 1935, UOB has grown significantly with a network of over 500 branches across 19 countries, including Singapore, Malaysia, Indonesia, Thailand, China, and Vietnam.

With a strong digitalization strategy, UOB continuously invests in technology to enhance customer experience, optimize operations, and strengthen security. As a result, UOB collaborates with leading technology companies to implement innovative solutions aligned with its long-term growth objectives.

Industry: Fintech

Region: Singapore

- Innotech provides a highly skilled IT team specializing in banking and finance, enabling UOB to swiftly implement technology projects.

- Instead of investing in an in-house team, choosing Innotech’s IT outsourcing services allows UOB to flexibly scale its workforce up or down based on demand. This helps UOB optimize personnel costs and implement technology projects more efficiently.

- With over 10 years of experience in technology development for the banking and finance sector, Innotech has a deep understanding of operational processes and strict data security standards. As a result, the personnel provided by Innotech not only meet professional expertise requirements but also comply with the stringent standards of the banking industry.

Cao Phat Paper Co., Ltd

Cao Phat Paper Co., Ltd is a reputable paper manufacturing company in Vietnam, established in 2010 and headquartered in Tan Uyen, Binh Duong. The company specializes in producing and supplying a wide range of paper products such as jumbo roll toilet paper, household rolls, tissue napkins, paper towels, and serviettes, catering to households, offices, restaurants, hotels, and resorts.

Cao Phat Factory

Not only serving the domestic market, Cao Phat has also expanded internationally to markets including the United States, Europe, Southeast Asia, Japan, Australia, and more. In 2016, Cao Phat was honored as a Top Brand 2016 by GLOBAL GTA (Germany – EU) and the Vietnam Economic Research Institute.

In 2025, with a vision for stronger growth in international markets, and facing the limitations of traditional management methods which are costly and inefficient, Cao Phat was challenged to answer the question: “How to apply technology in management and operations?”

The key challenges Cao Phat needed to solve:

1. Warehouse Management and Product Traceability

(i) Old method:

– Warehouse in/out data was managed using Excel — fragmented and cumbersome.

– Inventory was manually consolidated from multiple Excel files or basic software lacking minimum/maximum stock alerts.

– Traceability required opening Excel files, manually searching for batch and product codes, and checking across sheets for input material information.

(ii) Problems:

– Files were not synchronized in real-time; updates were isolated by person.

– No alerts for stockouts or long-held items; no control over inventory turnover.

– Traceability was time-consuming, with no end-to-end system integration.

– No visual interface; only those familiar with the files could trace accurately.

(iii) Innotech’s Solution:

– Develop customized warehouse management software tailored to Cao Phat’s needs.

– Integrate automatic traceability features into the WMS.

– Apply AI to analyze data and help leadership visualize warehouse performance.

– Synchronize all data in one cloud-based system with real-time updates, accessible from anywhere with an internet connection.

2. Production Management

(i) With business scaling and market expansion, manual production management became problematic:

– Difficult to control production schedules; machine conflicts and delays occurred.

– No real-time link with warehouse and QC; errors discovered only after production.

– Unable to measure machine/human productivity; bottlenecks were unclear.

– Incident handling was slow and chaotic, relying on phone calls.

– Reports were delayed, inaccurate, and hard to verify or improve.

(ii) Innotech’s Solution:

– Smart production scheduling: Detect machine conflicts, late orders automatically, drag-and-drop interface.

– Flexible shift planning: Assign people, machines, and shifts clearly to avoid overlap.

– Assign orders to specific machines: Track which order runs on which machine, and for how long.

– Real-time integration with warehouse and QC: Check input materials beforehand, issue alerts for shortages or off-standard items.

– Track machine and labor performance: Measure productivity, identify bottlenecks for optimization.

– Structured issue handling: Create error tickets, trigger technical notifications automatically.

– Real-time, automated reports: Enable faster review, improvement, and decision-making.

3. Quality Management

(i) Problems

– Each client has different quality standards, but no centralized system; risks of confusion and wrong delivery.

– Manual checks relying on human input — inconsistent and time-consuming.

– No inspection history for tracing when complaints arise.

– No early alerts — mistakes found only after products leave the warehouse.

– Manual reporting — lacks transparency and fails strict audits.

(ii) Innotech’s Quality Management Solution:

– Store custom standards per client: Systematically saved and categorized to avoid confusion.

– Automatically compare batches with client specs: Suggest suitable products for delivery.

– Pre-shipment quality checks: Only compliant items are approved for delivery.

– Traceability and inspection history: Transparent and accessible for review or issue resolution.

– Early alerts for non-compliant products: Proactively fix problems before dispatch.

– Quality reports by client, timeline, and batch: Support both internal and customer audits.

4. Accounting and HR Management

(i) Problems

– Manual entries or scattered Excel files: prone to errors, lack of coordination between departments (purchasing, sales, warehouse).

– Delayed data consolidation: leads to slow decision-making and poor cash flow visibility.

– Bookkeeping errors, mismatched revenue-expense data: risk of penalties during tax audits, or damaging investor trust.

– Manual financial reporting: time-consuming, hard to analyze or filter data.

– No project-specific debt/cost control: risks of bad debt, budget overrun, no early warnings.

(ii) Innotech’s Solution:

– Automated data capture and syncing: Direct integration with sales, purchasing, warehouse — no manual entries.

– Real-time cash flow tracking: Monitor balances, receivables, payables at all times.

– Debt and cost control by customer/project: Clear cash flow management, avoid overspending or capital misuse.

– Auto-journal entries: Reduce errors, save time for accounting staff.

– Fast, accurate financial and tax reports: Auto-generate standard forms (Financial Statements, tax declarations).

– Clear user permissions, high security: Users only see what they’re authorized to, preventing data leaks.

Benefits of Innotech’s Technology Solutions:

These digital solutions will help Cao Phat reduce costs and resource consumption across all management activities, while ensuring transparent, synchronized data throughout the system – enabling faster, more confident decision-making.

Product images:

Manulife

Manulife is one of the world’s leading insurance and financial services groups, headquartered in Canada. Operating in over 20 countries, Manulife provides life insurance, retirement, investment, and asset management solutions to help customers secure their financial future. In Vietnam, Manulife is one of the largest life insurance companies, pioneering technology adoption and innovation to enhance customer experience.

Industry: Insurance

Region: Viet Nam

Challenges:

- Lack of internal resources → Provided onsite support personnel

- Sought a software development supplier for both onsite and offshore projects

Project progress:

- Stage 1: Provided a qualified onsite team of up to 5 members

- Stage 2: Flexibly adjusted to project needs, supplying an onsite team of 3-5 members

- Stage 3: Expanded onsite resources to 10 members to meet urgent timelines

- Stage 4: Officially selected as the ODC supplier with a total of 20 members

Achievements:

Met Manulife’s standards to pass the security audit, becoming a trusted partner for onsite staffing and ODC operations.

- IT Onsite & Offshore Staffing: Supplying skilled engineers both onsite and offshore to optimize resources.

- Software Development & Integration: Enhancing and streamlining Manulife’s insurance systems.

- Operational Optimization: Automating processes and ensuring seamless system compatibility.

- Security Compliance: Meeting Manulife’s strict security standards to operate an ODC.