In the 4.0 industrial revolution, digital transformation for banking is a trend so that Fintech outsourcing companies in Viet Nam could be developed rapidly.

1. Mobile payment

When digital transformations for banking appear, the wave of mobile payment along with the trend of “no cash” is booming in Vietnam. Almost all banks in Vietnam have added Mobile Banking to their service ecosystem.

Mobile payment helps the customer more convenient and save time

Mobile payment helps the customer more convenient and save time

With the mobile phone, you can pay for: flight tickets, hotel reservations, movie tickets … With these utilities, customers can easily handle all shopping transactions with just a few operations on mobile phones. The application will automatically recommend flights, export movies, hotel rooms according to the criteria the user has chosen …

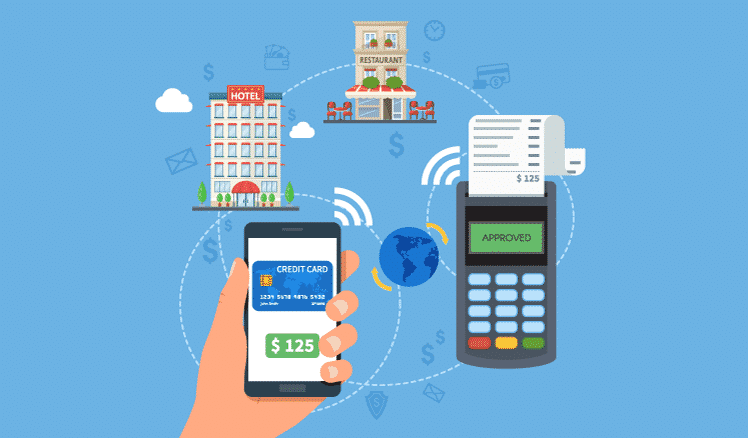

2. Payment of QR code

Paying by QR code is a popular payment method for stores today

Paying by QR code is a popular payment method for stores today

With the QR Pay solution, customers only need to use the Mobile Banking application of mobile phone banks to scan QR codes in seconds to be able to successfully pay at restaurants, supermarkets, shops, supermarkets. marketing or online shopping pages …

For businesses, QR Pay is a simple form of payment, requiring less investment in initial infrastructure. Only need to put a single QR code to accept payments through the Mobile Banking application of all banks such as payment at the counter, payment on invoices, payments on websites, Facebook, catalogues, leaflets, billboards…

Because of the special features of QR code, since 2017, it has been put into use by 17 major banks including BIDV, VietinBank, Agribank, Vietcombank, AB BANK, SCB, IVB, NCB, SHB, Maritime, Vpbank, TBbank. … with over 8 million users. Mobile banking outsourcing in Vietnam more than more was established and developed to meet the needs market.

3. Card Digitization

Tokenization (Card Digitization) is a data security solution based on the technology of replacing “sensitive” payment data with token code, in order to improve the security and safety in online payment.

Registration for Card Digitization, customers only need to enter the payment information for the first time, the card data will be encrypted and saved on the platform. Subsequent transactions, customers don’t need to re-enter the card’s details, only need to verify it to be paid immediately. This is considered a utility suitable for payment needs on mobile devices such as mobile apps, tablets, with IOS or Android operating system.

With the support of Napas National Payment Joint Stock Company, since January 2018, FPT Telecom Joint Stock Company has applied Tokenization technology in payment of Internet and TV charges.

4. E-wallet

Vietnam is one of the fastest-growing, potential mobile payment application markets in the world and has a strong impact, promoting the growth of electronic payment in general and electronic wallets. One of the e-wallets that are gradually dominating the Vietnamese market today is Momo. Serial success, many starts-up in Vietnam also search for a chance mobile banking software outsourcing marketing in the world.

Some e-wallet popular types today

Some e-wallet popular types today

By simply connecting card information via e-wallet, users can easily pay from car service, food, movies … to pay for essential family services such as electricity, water, tuition. … without having to go back and forth.

One feature that makes e-wallets attractive in Vietnam now is that it is free of all payment transactions, transfers, and points for regular non-cash payment customers. Moreover, when shopping on e-commerce sites, users can keep their card and bank accounts confidential without having to provide them to websites via e-wallets, limiting their leaked information.

5. Chip card

Vietnam Bank Card Association (VBCA) in collaboration with Vietnam National Payment Joint Stock Company (NAPAS) and the first 7 banks including Vietcombank, Vietinbank, BIDV, Agribank, Sacombank, TPBank, ABBank officially announced launching domestic chip card products of leading banks in the trend of issuing chip cards to customers in the near future. This is the final digital transformation for banking popular in Vietnam today.

The chip card is the information inside the encrypted chip and only the issuing bank can read the data in the card and the chip card is difficult to counterfeit. Therefore, the change from a magnetic card to a chip card will limit the crime of stealing card data to create fake cards to withdraw money.

Take advantage of the safety, security, fast transaction speed of Chip card to connect payment for public services, utilities, benefits such as transportation, health care, insurance …; expand international cooperation to learn experience from implementation, develop new and modern payment features for domestic card products; towards providing multi-card, multi-utility, and multi-card products.

Innotech Vietnam always strives to meet the needs of customers with the highest quality products and services. So we have received the trust from big companies such as ACB, Tyme Bank, Unifimoney, Manulife, Commonwealth Bank, … to use products created by Innotech Vietnam.

If you are looking for a Fintech Outsourcing company to provide solutions for your company. Contact experts at Innotech Vietnam for any questions about Fintech software Outsourcing!

Email: [email protected]

Share your information