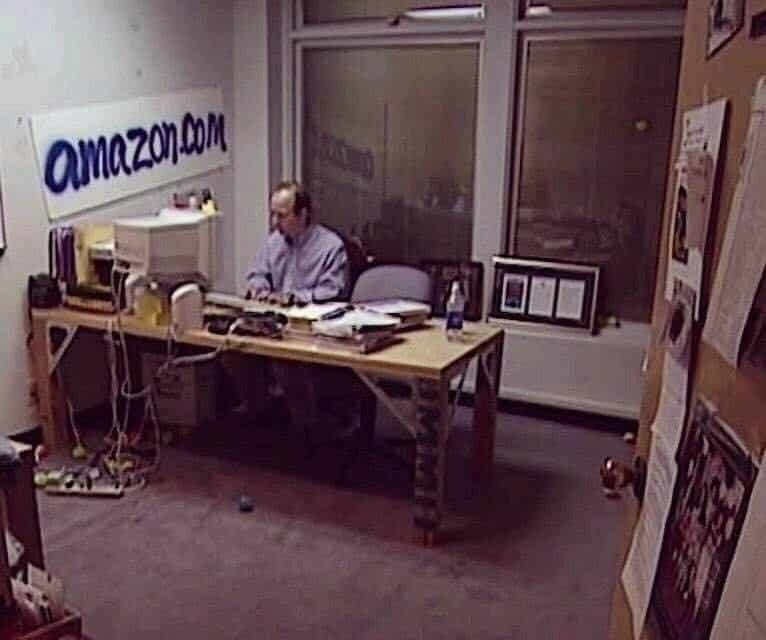

20 years ago this was Amazon.com

In the short time since then it has become the world’s largest online merchantand fundamentally altered the way we shop forever. If an illustration of disruption were sought this is a pretty good example.

We are still at the earliest stages of the true impact of Fintech in financial services. There has been no such similar disruption of financial services outside of China and Kenya. The top 10 banks 20 years ago in practically every market remain the same today as in 1999. The eruption of new Challenger Banks and alternative Fintech players, the funding they are attracting and their valuations suggests that there is a lot of expectation that this disruption is coming.

Three likely scenarios for the future of fintech are:

- Traditional financial services companies maintain their dominance by absorbing the best of Fintech

- Fragmentation of the market into many niche plays with decreasing share and relevance of traditional players

- Rise of mega Fintechs to replace the dominance of traditional players

Scenario 1 — Traditional companies win in a long war

The resilience of traditional banks in the face of increasing pressure from alternative Fintech is a combination of customer apathy, complex regulation and market structures and challenging economics. This gives banks a lot of time to figure out how to compete. If there is a war between traditional banks and Fintech it’s likely to be a long one and they are approaching the challenge in a diverse number of ways.

Competitive strategies include launching digital offerings such as Chase and Finn to acquiring or investing in Challenger Banks as BBVA has done with Simple and Atom as well as offering its own API marketplace and bank as a service solution to others.

In this scenario the traditional companies absorb the best created by Fintech driven innovation and survive and thrive long into the future.

Scenario 2 — Death by a thousand cuts

Given the traditionally high costs of entry financial services has evolved slowly with limited competition driving slow change leading to the creation of large dominant companies.

The costs and time involved in setting up an alternative financial services company have plummeted with technology and regulatory changes. The emergence of banking as a service players like SynapseFI, Bankable, Backbase, Q2 and others is only helping to accelerate this evolution.

With the falling costs and increasing competition new companies are able to look to serve very specific niches — something that was previously unnecessary as well as cost and technically prohibitive. Taken to an extreme this could see the emergence of super specific plays in financial services focussed on the social, psychological, economic and geographic needs of consumers. Digital nomads have their own needs? There is an app for that.

Photo by Jakob Owens on Unsplash

In this model the incumbent banks bleed out customers over time as they migrate to the service or services that better meet their very specific needs.

Scenario 3 — Dinosaurs to whales

As dinosaurs used to rule the earth only to be replaced by mammals, in this scenario we see the emergence of super Fintech’s that unseat the incumbent players and replace them.

These are the Fintech’s that break out of the pack and and manage to scale to the same or similar dominance as the banks of today.

This is the scenario it seems many in the industry are implicitly assuming although we are yet to see the model emerge that will get us there.

No doubt looking back in 2039 and with the benefit of hindsight it will all seem remarkably clear how the future was to unfold and all the signs pointing towards it that we are missing now.

What does seem clear is that the speed of change and scale of innovation in Fintech is only going to increase in the next few years. Which of the 3 scenarios, or maybe others, will be the eventual winner is hard to predict, it’s not just market forces but the macro economic and political environment that will influence the outcome and those are even harder to predict as Brexit, the US political scene and every Black Swan in history has shown us.

Original Source: Ben Soppitt – Founder Unifimoney

Contact experts at Innotech Vietnam for any questions about Software outsourcing for Fintech!

Email: [email protected]