During the pandemic, Fintech still grows up and stays strong. The reason is people now relied on virtual financial services as they cannot go out for any offline transactions. People also believe that one person in cities and big cities uses Fintech at least one time in their lifetime.

Now let see what is top Fintech trends to consider in 2021.

1. Banks build up Digital Banking function as a matter of course

The world is mobile and so are its banks. Banks have to build their Digital Banking function to adapt the trend of the world, especially in the pandemic that most people believe that it cannot be controlled 100% within 2021 and even 2022.

All thanks to the growth in Biometric, Artificial Intelligence, and Cybersecurity, Digital Banking is easier to access than ever. Consumers will be able to execute every important task while accessing a huge range of financial information.

2. Neobank will grow up strongly

Based on 100% digital operating, Neobank is executed without any help from traditional bank establishments and well-known since 2017 as a viable FinTech solution for easing the challenges faced by traditional banks.

People believes Neobank will also develop its influence in Asian countries where traditional banks are being used as a big habit almost 20 years ago. In 2021 and even the next year, for sure businesses will think of Neobank more and more due to the pandemic and the advantage it brings to customers.

3. Will Artificial Intelligence (AI) and machine learning take over the world?

Artificial Intelligence (AI) can help business to identify financial frauds and mitigate cybercrimes. Therefore, there’s no reason that businesses across the globe are considering integrating their operations with Artificial Intelligence, especially banks. As many researches, AI will reduce operational expenditures by 22%. Therefore, a bank where is integrated AI can save as much as $1 trillion.

4. Regulatory technology in banking and financial services

A regulatory technology solution will be able to perform the following operations:

- Transaction monitoring

- Regulatory reporting

- Identity management

- Risk management tasks

Regulatory technology will enable businesses to use software that will simplify all the compliance processes associated with federal and state laws and regulations.

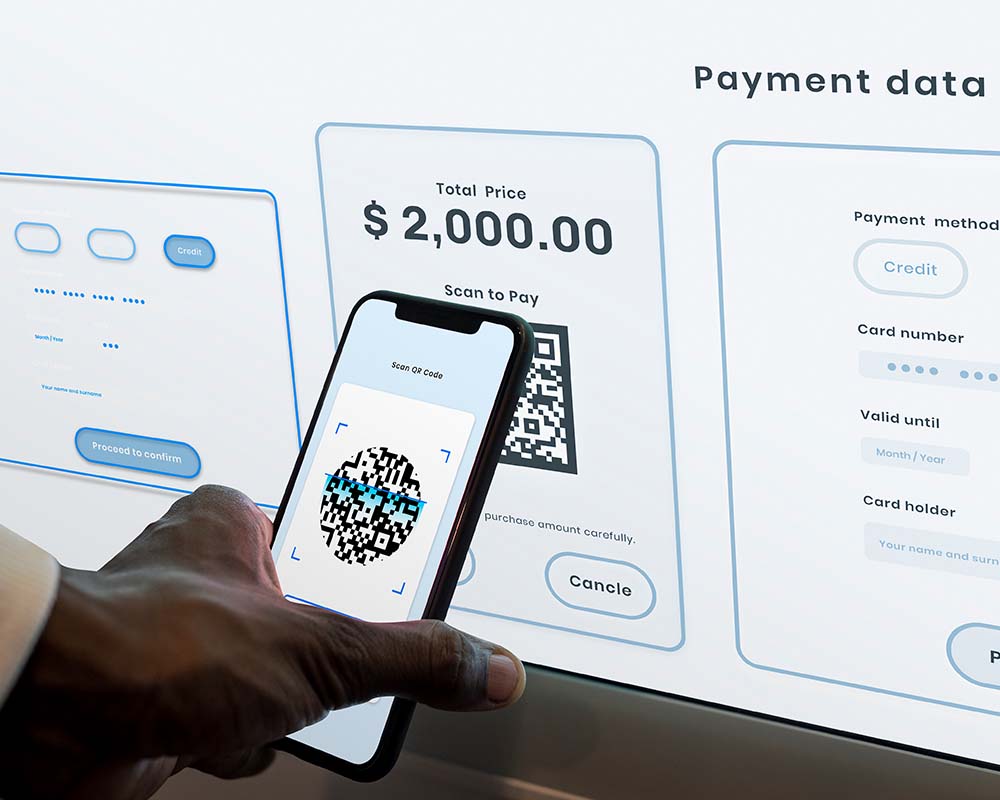

5. Innovative payment options for e-commerce and more services

We have seen mobile wallets, mobile payments, contactless payments, AI for security, ID verification tech, and smart speaker system. They’re all innovative payment options that cannot be replaced in e-commerce and some people’s choice nowadays as well as in 2021 and next years.

People believe e-wallet will replace physical wallets as a big tendency in the world.

6. Voice-activated technologies of FinTech

Voice assistants provide an excellent experience when one has a query. Voice-activated tech is powered by AI and is set to improve the customer experience in the banking sector. As of now, voice assistance can do the following tasks:

- Set up recurring payments

- Replying to typical questions

- Provide basic financial info

- Direct customers to the right place on a website

- Categorize customer calls

7. Robotic process automation (RPA) will automate tasks

Robotic process automation (RPA) uses digital workers or robots to automate routine tasks. Fintech has already implemented the RPA tech to improve productivity and overall workplace efficiency. And it also cuts down the operational costs for banks or businesses.

See more: Fintech – Robotic process automation

8. The explosion of e-commerce FinTech

Covid-19 forever altered the definition of online shopping. Most countries will continue to see unhindered, explosive growth in e-commerce in the coming years. As per research, because of the pandemic’s restrictions, 40% of internet shoppers switched to e-commerce options, and 45% more people turned to online shopping than before the pandemic.

9. Control of large amounts of data

Organizations often collect a large amount of structured data, which comes from loan application forms, tax records, and bank statements, among other sources. Good data insights are important for finding opportunities and improving goods and services, so managing all knowledge efficiently is a key priority for 2021.

FinTech developers can create application that collect data easily and reliably, allowing data processing to speed up.

10. Blockchain of FinTech

Blockchain technology has fully changed the Fintech industry by allowing for safe and stable transactions. People believe that Blockchain technology would have the greatest effect on banking in 2021 and beyond.

One of the most significant aspects of Blockchain is that it is a modern finance that focuses on reducing centralised procedures. It ensures that stored data is protected from beginning to end with minimal risk and that the data is kept safe.