In the technology revolution, fintech solutions are changing the way businesses operation and the user manages their payments.

These are some fintech solutions are making payments easier for consumers as well as businesses that have applied.

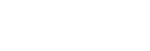

Blockchain technology and payments

Fintech Company disrupts the financial and banking industry primarily through blockchain technology. With this technology, the fintech solution had used blockchain to record transactions and track users’ assets. The great thing that the information will be stored on the network of personal devices and has it’s own password-protected against theft. So it solves the security issue in online transactions.

Blockchain help recording and tracking transactions easily

Blockchain help recording and tracking transactions easily

In addition, the fintech financial services from the blockchain help pay faster at a reasonable price from cutting intermediaries. For those who need to operate international transactions, this helps save costs and reduce the time a lot.

Recording and tracking transactions make banks’ payment systems easier to better manage flow payments, manage risks and improve flexibility. Therefore, banks respond more easily and quickly to changing needs and market conditions.

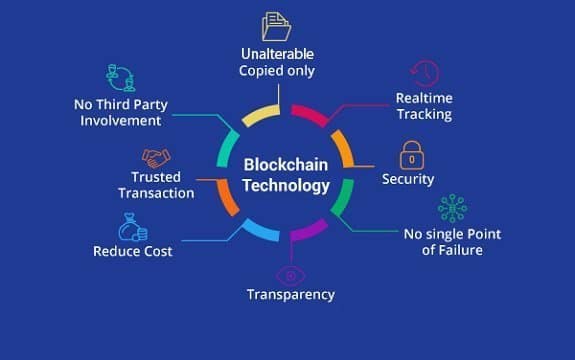

Alternative payment methods

Usually, if you want to make a payment, you have to log in to your bank account and manage everything from there. Therefore, a fintech solution to be more convenient for users is to develop alternative payment channels. You can then make instant payments without having to log in to a bank account.

Some Fintech companies allow users to make payments through social media accounts, such as Facebook Messenger or Twitter. This is a fintech solution that makes it easier and faster for users to pay. When one of your contacts asks for money, you don’t have to leave the app and log into the bank’s app, which you can pay right away on that application.

Facebook has online money transfer from the Messenger app

Facebook has online money transfer from the Messenger app

The revolution of mobile payments

Traditionally, people often used transactions through their credit or debit card. But one problem with these transactions is that anyone can enter your PIN, which is essential for fraud.

Therefore, fintech’s solution is mobile payment, which can solve this problem. In the case of mobile wallets, all data is encrypted and this makes the information impossible to steal. Another great advantage of mobile wallets is that these allow for easier online transactions. This helps increase sales of online retailers as it drives consumers to buy more often. Besides increasing the payment security level, e-wallets can also store other types of information, such as loyalty points.

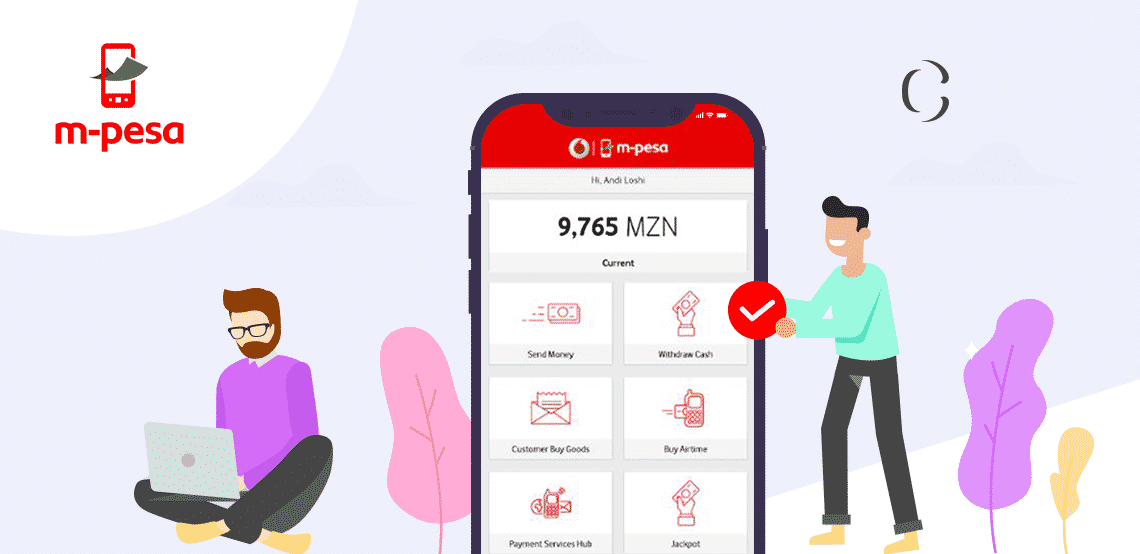

Mobile payment is becoming a popular form of payment in the world. Kenya is famous for the M-PESA mobile payment service, which is the banking software development of Kenya’s largest carrier – Safaricom. The service was launched in 2007 and now has nearly 20 million users.

M-PESA is a famous mobile payment in Kenya

M-PESA is a famous mobile payment in Kenya

Innotech Vietnam always strives to meet the needs of customers with the highest quality products and services. So we have received the trust from big companies such as ACB, Tyme Bank, Unifimoney, Manulife, Commonwealth Bank, … to use products created by Innotech Vietnam.

If you are looking for a Fintech Outsourcing company to provide solutions for your company. Contact experts at Innotech Vietnam for any questions about Fintech software Outsourcing!

Contact us: Click here

Share your information