There are many companies on the market that provide Fintech app development services, however not all of them fit the needs of enterprises. Therefore, choosing a reputable company that can meet the requirements of specialization in Fintech app development is extremely necessary. In this article, you will learn about the 5 best companies providing Fintech app development services in 2025.

1. Top 5 companies providing Fintech app development in 2025

1.1. Innotech – a leading technology partner in Fintech app development in Vietnam

With more than 12 years of experience in financial – banking software development, Innotech has become one of the trusted partners in the field of fintech software development. Innotech Vietnam owns a team of experienced software engineers and competitive costs with international quality.

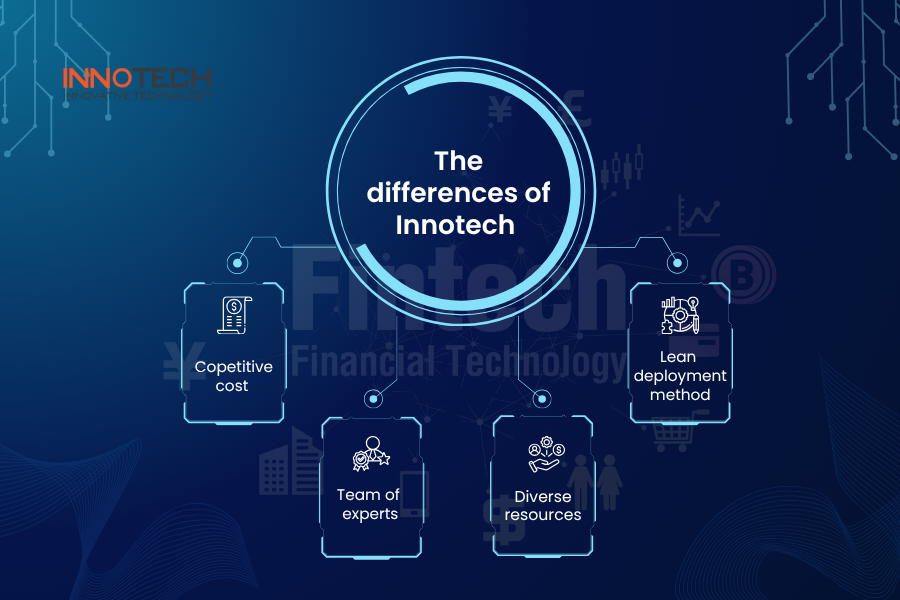

The difference of Innotech

What makes Innotech different in providing fintech app development services is the combination of deep expertise in BFSI and the ability to deliver cost-optimized technology solutions:

-

Competitive cost: High-quality human resources in Vietnam with only 20% of the cost compared to the US and Europe, but enterprises still ensure quality for fintech app development services. In particular, the support service after fintech app development will not incur additional costs, ensuring that businesses receive the service in the most complete way.

-

Team of experts in Fintech app development: Innotech has experience implementing technology for many banks and large financial institutions such as ACB, UOB, Unifimoney, Tymebank, … Therefore, Innotech’s IT team has deep knowledge of operations, workflows, security principles, … of financial institutions and banks.

-

Diverse resources: A large team of engineers, fluent in English, familiar with international working culture, meeting diverse needs in customers’ specialized fintech app development.

-

Lean deployment method: Combination of Agile and Developers, optimizing product launch time, minimizing risks, and improving efficiency.

The difference of Innotech in providing fintech app development services

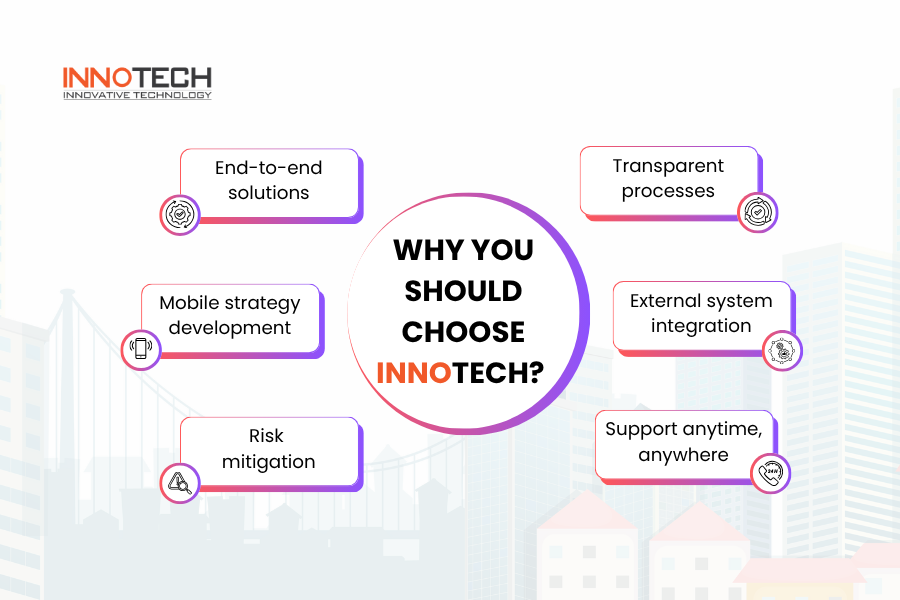

Why should you choose Innotech as a technology partner in fintech app development?

-

End-to-end solutions: Handling the entire process from requirements gathering, design, development to deployment.

-

Mobile strategy development: Providing consultation and application development tailored to your business model and budget.

-

Risk mitigation: Signing NDAs and applying security technologies to protect your data.

-

Transparent processes: Clear and reasonable pricing with a commitment to no unexpected costs.

-

External system integration: Building APIs to ensure flexible data connectivity and easy scalability in the future.

-

Support anytime, anywhere: Regular maintenance and 24/7 customer support.

Reasons why you should choose Innotech

Leave your information here to get detailed consultation on fintech app development services.

1.2. Accenture

Accenture is one of the consulting and technology corporations with extensive experience in the BFSI sector. Throughout its operations, the company has participated in many international fintech app development projects. With a large global workforce, Accenture is known as a familiar partner of many financial institutions.

Accenture Fintech app development company

Accenture provides fintech app development solutions

Accenture is a good choice for BFSI businesses in fintech app development because:

-

Global scale and multidisciplinary expertise: Not only providing fintech app development services, Accenture also has a strong foundation in management consulting, data, and AI technology, helping businesses have a comprehensive vision.

-

Large-scale deployment capacity: While many providers only focus on SMEs, Accenture is capable of developing fintech apps for banks, multinational financial groups, handling transaction systems with millions of users.

-

Compliance and security commitment: With international standards (ISO, PCI DSS, GDPR…), Accenture brings absolute peace of mind in terms of legality and security for BFSI customers.

1.3. Cognizant

Cognizant is one of the information technology services and consulting companies with extensive experience in the BFSI industry. With more than two decades in the market, Cognizant has carried out numerous projects related to fintech app development. With a workforce operating in many countries, Cognizant is considered a reliable technology partner for many large financial institutions. The value the company brings focuses on sustainability, efficiency, and long-term companionship.

Cognizant Fintech app development company

Outstanding differences

-

Extensive experience in fintech app development: Strong foundation with past collaborations with many banks and global financial institutions.

-

Focus on emerging technologies: Applying AI, big data, and cloud computing in fintech app development, helping customers optimize processes and improve experience.

-

High customization capability: Specialized fintech app development tailored to customer needs, especially suitable for financial institutions with complex systems.

1.4. Infosys

Infosys is one of India’s most reputable technology corporations. To date, Infosys has more than 25 years of partnership with global financial institutions and is present in more than 100 countries. With a flexible and scalable platform, Infosys is considered one of the leading banking-as-a-service (BaaS) solutions, helping banks enhance competitiveness in the digital era.

Infosys Fintech app development

Outstanding differences

-

Advanced core platform: Built on open and cloud-native architecture, allowing AI, blockchain, API banking integration, offering high flexibility in fintech app development.

-

Customer experience orientation: Focused on creating a seamless digital journey, not only improving backend but also enhancing end-to-end experience on web and mobile.

-

Large-scale deployment capacity: A team of more than 300,000 global employees capable of developing fintech apps handling massive transaction volumes.

1.5. Tata Consultancy Services

Tata Consultancy Services is one of the largest technology corporations in India and the world, under Tata Group, with more than 50 years of experience in IT and financial – banking services. Its technology solutions have been deployed in more than 100 countries, serving hundreds of banks, insurance companies, and financial institutions.

TSC Fintech app development company

Outstanding differences

-

Comprehensive solutions: Not only focusing on fintech app development but also covering insurance, securities, digital assets, and payments – creating a complete financial ecosystem.

-

Flexibility and scale: Cloud-native and API-driven solutions, easily deploying fintech app development on a global scale and quickly adapting to legal or technological changes.

-

Innovation focus: Strong investment in R&D, integrating blockchain, AI, and big data analytics to support banks in rapid fintech app development.

2. Notes when choosing a company providing fintech app development services

2.1. Experience and reputation in fintech app development

When choosing a company providing fintech app development services, businesses should consider the length of time the company has been operating in this industry. In addition, factors such as the number of projects implemented and the type of customers they have served are also criteria that businesses should care about when developing fintech apps.

Reputation and experience are important criteria to choose a fintech app development company

2.2. Scale of fintech app development of the service provider

Each business has different needs in fintech app development. Depending on financial capacity, company size, and customer service goals, businesses can choose a suitable model. Large corporations such as Accenture or TCS focus on large-scale deployment, while SMEs may need more flexible and cost-optimized providers.

2.3. Methods and speed of fintech app development deployment

Some companies apply Agile and developers to speed up progress and ensure transparency. Conversely, some companies tend toward traditional models with multiple control layers. Businesses need to weigh between fintech app development speed and the level of control, information security of the service provider to make the right choice.

Methods and speed in implementing fintech app development are vital

2.4. Service portfolio and supporting technologies in fintech app development

Businesses should evaluate the breadth of services, from fintech app development (e-wallet, P2P lending, blockchain…) to digital transformation, AI, and security. A comprehensive partner will help businesses with long-term strategies and easy product expansion in the future.

2.5. Cost, security, and legal compliance in fintech app development

The costs that businesses need to pay for fintech app development are not only service prices but also contract terms, scalability, and maintenance costs. At the same time, businesses should also care about security standards and risks in fintech app development. These are mandatory factors for fintech app development to be effective and safe.

See more: How many types of contracts are there in mobile app development?

This is the article about Top 5 companies providing Fintech app development in 2025. Hopefully, this article will bring you the most useful information. For free consultation and to answer questions about fintech app development services, please leave your contact information here!